5 Tax and Structures

Comparison of all entities

Tax for partnership

The income for each individual in a two-person partnership for investment purposes is half of the net income of the partnership.

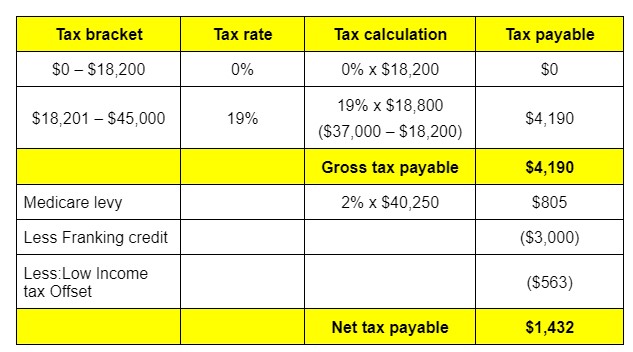

Therefore, in the example the taxable income for each partner is $40,250 which is half of $80,500. They also receive a franking credit of $3,000 each.

The calculation of tax for each individual in 2025/26, based on a taxable income of $40,250 is shown in the table opposite.

Both partners must pay tax of $770 each, being a total of $1,540

This tax is $9,008 lower than for the individual in the previous example as the partners can split their incomes between the pair of them.

The benefit occurs because each partner can access the $18,200 tax-free amount as well as lower marginal tax rates and the low-income tax offset.