5 Tax and Structures

Capital gains tax

Capital gains tax example

Fred's new taxable income is $72,000 plus $25,000 giving a total taxable income of $97,000 in that year.

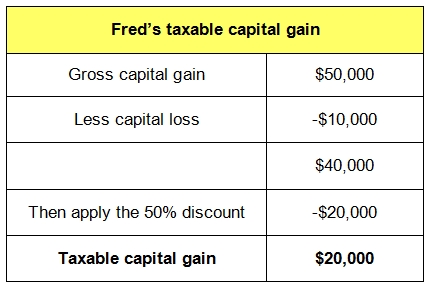

If Fred also had a capital loss in that year of $10,000 on the sale of other investments, the net taxable capital gain would be $20,000 ($50,000 less $10,000 = $40,000 less 50% discount) as shown in the table opposite. It is important to note that any capital loss is deducted from the capital gain made prior to applying the 50% discount.

Under this scenario, Fred's total taxable income is now $72,000 plus $20,000 being $92,000.